The buzz around the 8th Pay Commission has reached a new pitch, as recent cabinet approval and government signals have fueled hopes that many central government employees might soon see a substantial jump in their salaries — potentially even reaching take-home pay of up to ₹ 90,000 per month for higher-level staff. While nothing is final yet, the developments indicate that 2026 could mark a major shift in the pay structure for lakhs of employees and pensioners across the country. Given inflation, rising living costs, and long-pending demands for revision, the timing seems ripe for a comprehensive overhaul.

The government formally approved the Terms of Reference (ToR) of the 8th Pay Commission in late 2025, paving the way for a full review of basic pay, allowances, pensions, and other benefits. According to official estimates, this revision may impact approximately 50 lakh active central employees and around 69 lakh pensioners nationwide. Amid this backdrop, speculations and salary projections have begun — some more optimistic than others — but many experts believe a substantial pay raise is possible.

What Has Changed: 2025–2026 Developments for 8th Pay Commission

After years of anticipation and informal discussion, 2025 witnessed a decisive push: the government cleared the ToR for the 8th Pay Commission, formally launching the process to review the entire pay and pension structure for central employees and pensioners. This step is more than procedural — it signals that the next revision is no longer a distant possibility, but an active process underway.

The intention now is to align government salaries and pensions with current economic realities — inflation, increased cost of living, and changing expectations. Officials have publicly acknowledged these pressures, and have promised that once the Commission submits its recommendations, efforts will be made to implement revised pay scales retrospectively from January 1, 2026.

While earlier pay revisions have sometimes taken time to translate into actual increases, this time there’s a push to fast-track disbursement — though final amounts will depend heavily on the “fitment factor” the commission recommends.

What Experts and Analysts Expect — Fitment Factor & Possible Salary Range

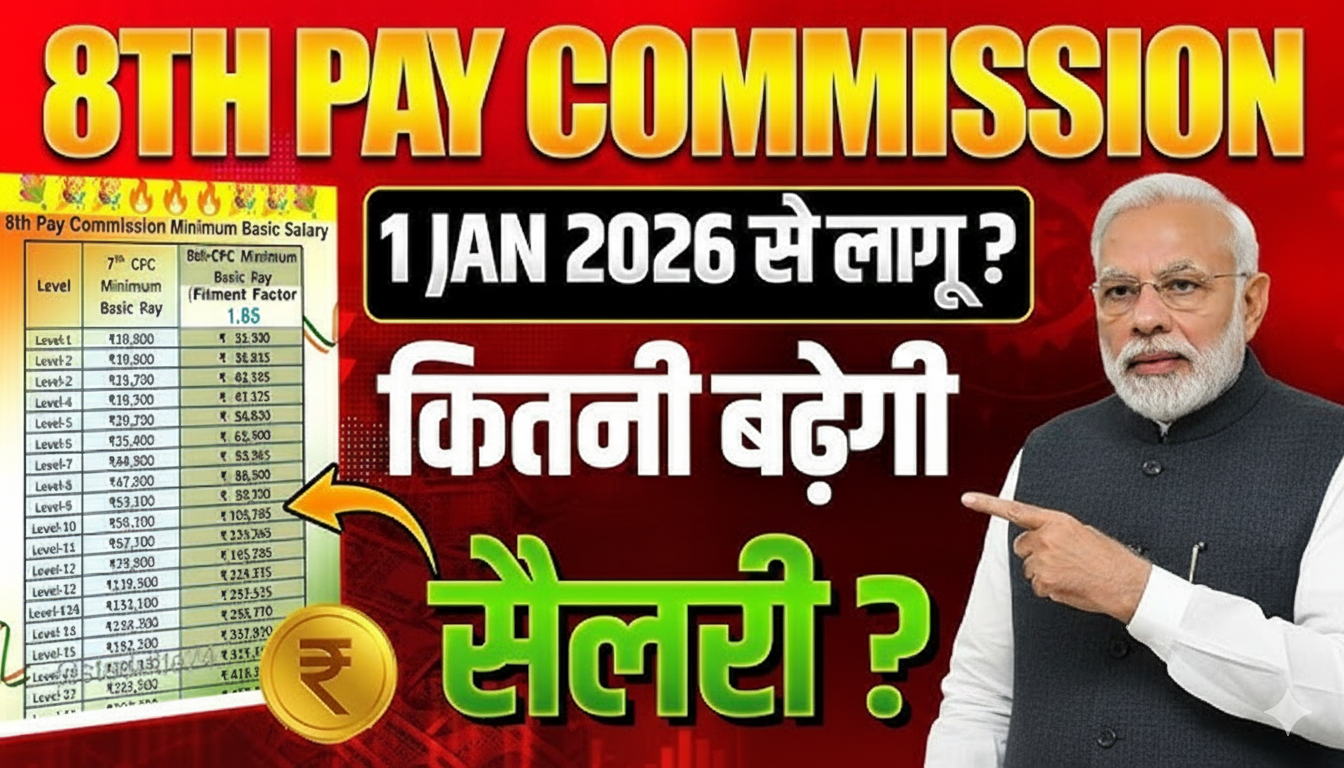

At the heart of any pay revision is the fitment factor — the multiplier applied on existing basic pay to calculate the revised basic salary under the new pay commission. Analysts now suggest the 8th Pay Commission might recommend a fitment factor in the range of roughly 2.6 to 2.86, though others caution that actual multiplier could be more modest.

If we apply a higher-end multiplier (say 2.8), an employee currently drawing a basic pay of ₹20,000 could see the new basic crossing ₹50,000–₹55,000. With allowances, dearness allowance (DA), HRA, and other perks included, total monthly salary for mid- to senior-level officers could indeed approach or even cross ₹ 90,000. This is what gives rise to the ₹ 90,000 “upper-limit” expectations being discussed widely.

But it’s not only about fitment. The revised structure may also merge or recalibrate allowances, reset DA, and redefine pay bands — so take-home pay will depend on a combination of factors.

Some brokerage reports are cautioning that the minimum pay may rise modestly — for Grade-C or entry-level staff, projections sometimes show the minimum monthly pay might increase from the current ₹18,000 to around ₹30,000 under a lower multiplier.

Still, for the majority, a 30–34% salary hike across the pay matrix is widely expected.

Could ₹ 90,000 Salary Be Realistic? What Needs to Align

For someone to reach a monthly salary near ₹ 90,000 under the 8th Pay Commission, several conditions must align:

- A high fitment factor recommendation (near upper side 2.8–2.86)

- Pay level in middle-to-senior grade (so basic pay is already decent)

- Allowances (HRA, transport, special duty, etc.) preserved or enhanced

- Dearness Allowance (DA) and other inflation-linked perks factored properly

- Conservative tax deductions or minimal extra deductions

If all these parameters align, it is not fanciful to expect a take-home approaching ₹ 90,000 for many officers, especially in higher pay levels. That is why some employees and observers are optimistic — it’s within the realm of possibility, though not guaranteed.

However, it is equally possible that the final hike may be moderate — perhaps 20–30% overall — because the government must balance fiscal burden and budget constraints before finalizing the pay structure.

What Happens to Dearness Allowance (DA) and Allowances Under 8th Pay Commission

One significant factor that affects take-home pay is Dearness Allowance (DA). Under the previous pay commission, DA was often adjusted periodically, depending on inflation. But experts now expect that under the 8th Pay Commission, DA may be merged with basic pay (as was done partially earlier) or recalculated using a new methodology.

This could mean two things: for some employees, salary will see a neat increase because DA is baked into basic; for others, especially if allowances are cut or merged, the net benefit may be lower than expectations. The commission is reportedly reviewing nearly 200 allowances — some may be scrapped, others merged, to simplify structure — which means allowances that employees currently get may change.

So while a pay hike is plausible, the final take-home will depend on how many allowances are retained, and how DA is structured post-revision.

For Whom ₹ 90,000 is Most Realistic – Who Stands to Gain the Most

Based on current data and projections, the following categories are most likely to see their salaries inching toward ₹ 90,000:

- Officers in mid-to-senior levels (e.g. Level 8–14 in pay matrix, or equivalent)

- Employees with longer service and higher basic pay under old structure

- Those receiving substantial allowances (HRA, location-specific allowances, special duty)

- Pensioners who will also get proportionate increase plus DA adjustments

Entry-level and lower-grade employees (Grade C, entry pay) are less likely to reach the ₹ 90,000 mark because even with a strong multiplier, their basic pay will still be low — but they may see a meaningful raise that improves their livelihood.

For pensioners, benefits will depend on how pension is recalculated — most likely using revised basic + DA/allowance structure, which could significantly boost monthly pension from current levels.

Why Some Experts Warn Not to Expect Too Much — Realistic Timeline & Fiscal Pressure

While the optimism is understandable, several experts caution against overly high expectations or fixed beliefs. For one, just because the Commission has been constituted doesn’t mean hike will immediately reflect — it takes time to finalize report, get cabinet approval, budget allocations, and implement changes. For example, some reports suggest the full pay revision may only take effect in late 2026 or early 2027, even if the nominal effective date is January 1, 2026.

Also, if the allowance structure is trimmed or some allowances are merged or removed, the net benefit may shrink — especially for lower and mid-level staff whose allowances form a larger portion of take-home salary.

The fiscal burden on the government is also a serious consideration. Implementing steep hikes across lakhs of employees and pensioners could cost the exchequer several lakh crores, which could lead to resource allocation pressures, delay in disbursement, or staggered implementation.

Therefore, while a high salary of ₹ 90,000 per month is possible for some, it might remain aspirational for many until all factors align.

What Employees Should Do — Manage Expectations, Stay Updated, Plan Finances

Given the uncertainty and many moving parts, here are some prudent steps for central government employees and pensioners:

- Keep track of official announcements — just because rumours are circulating doesn’t mean final decision; rely on authorised government notifications.

- Use online calculators (when released) to estimate expected revised salary or pension based on your current pay level and allowances.

- Avoid overestimating — plan budget increases or loans only after actual confirmation.

- Keep documentation updated — for pensioners, ensure records, family details, bank details, etc. are correct for smooth pension revision.

- Prepare for transitional delays — even if the effective date is Jan 1, 2026, actual receipt of revised pay/pension may take more time.

What This Means for the Larger Government Workforce & Pensioners

If the 8th Pay Commission delivers as many expect, it could revive purchasing power for millions. Increased salaries and pensions would likely boost consumer demand, improve living standards, and ensure better social security for retired employees. For pensioners, better pensions may ease medical and living expenses in old age.

At the same time, a large hike may pressure government finances — potentially affecting budget allocations, welfare spending, and fiscal deficit. The government will need to balance generosity with economic sustainability.

For the workforce, higher pay may improve morale, reduce attrition, and make government jobs more attractive compared to private sector opportunities. For the retired and elderly, enhanced pensions may bring dignity and financial comfort.

Final Take: ₹ 90,000 Salary Is Possible — But Not Guaranteed

The ongoing 8th Pay Commission process has opened real possibilities for a major salary renaissance in the government sector. A salary of ₹ 90,000 per month for many officers is within the realm of possibility — especially for higher-level staff, once fitment factor, allowances, and DA adjustments align favorably.

However, there remain significant uncertainties: final fitment factor, allowance restructuring, actual implementation timeline, and government’s fiscal constraints. So while employees should remain hopeful, they should also keep expectations realistic until official notification arrives.